Why Pflugerville Homeowners Need This Insurance Claims Guide

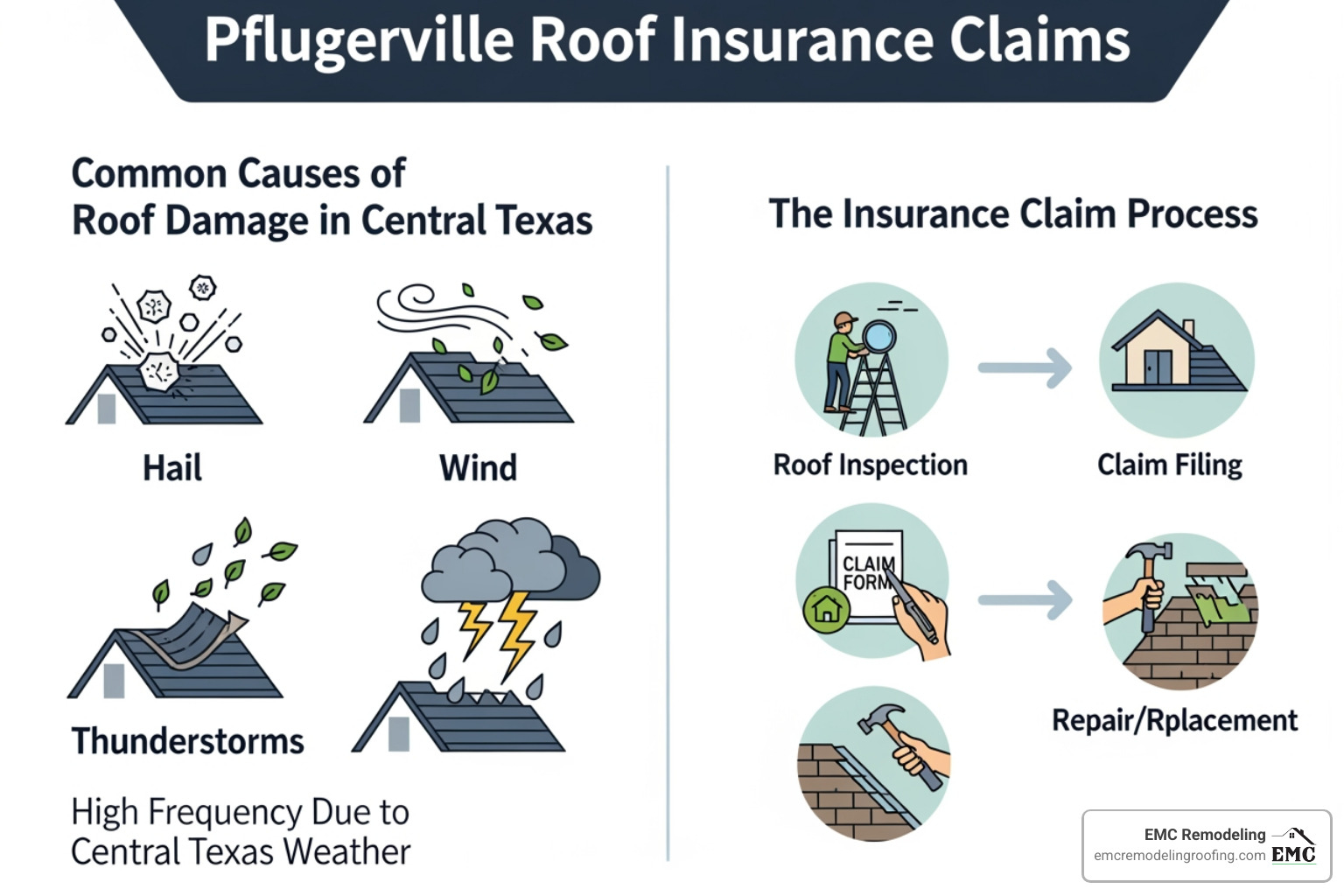

Roof insurance claims in Pflugerville, TX are not rare events; they are a routine part of homeownership in Central Texas. Historical storm data from the National Weather Service shows that the Austin–Round Rock–Georgetown metro area, which includes Pflugerville, experiences more than 30 severe weather events annually, with hail and straight-line winds as leading causes of roof failures. That volume of storms makes a clear, step-by-step claims guide just as essential as a good roof. For fast support from a local expert team, you can always start with our Central Texas roofing specialists.

Quick Answer: How to Successfully Steer Your Pflugerville Roof Insurance Claim

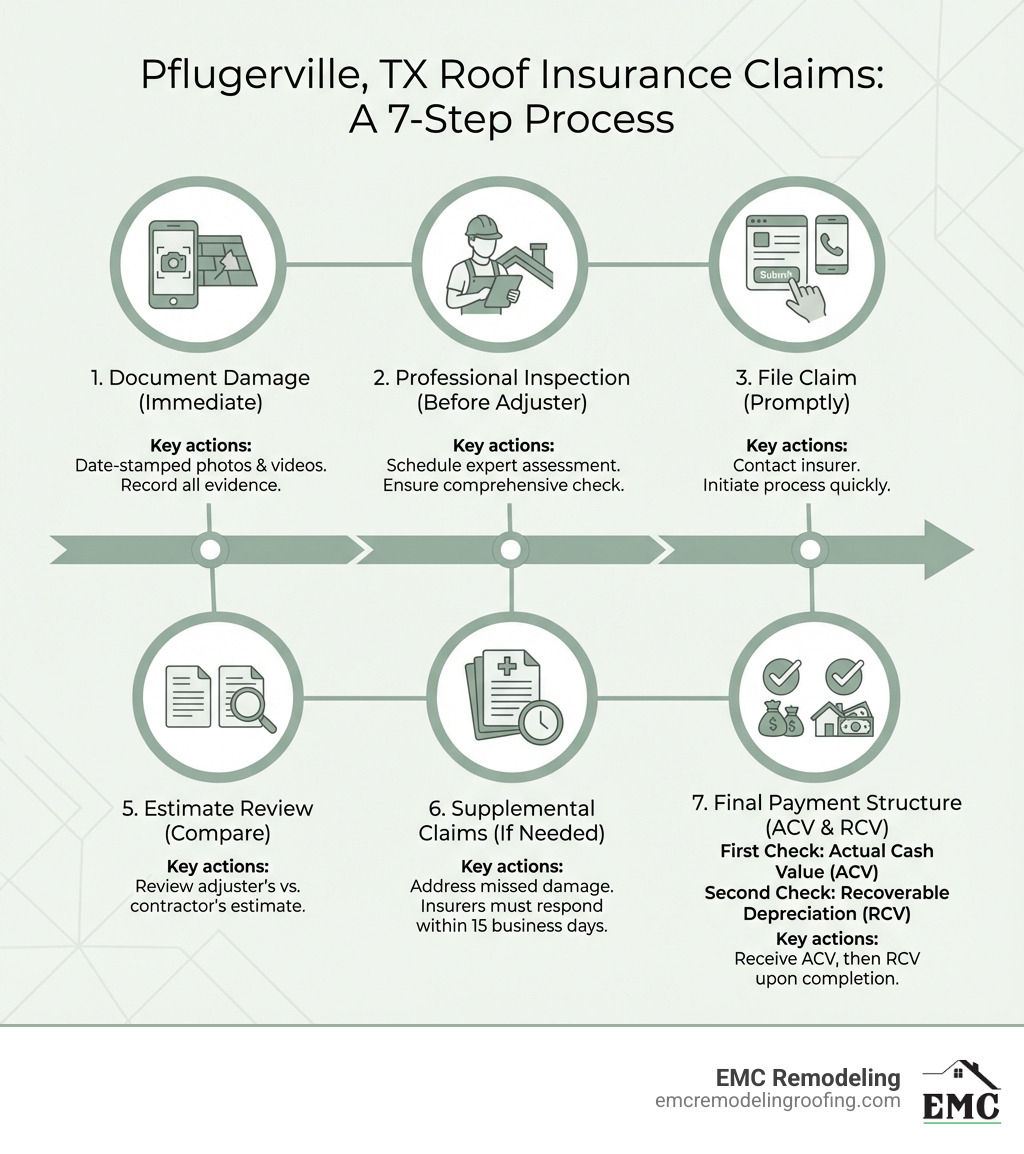

- Document damage immediately – Take date-stamped photos and videos of all roof damage.

- Get a professional inspection – Schedule a free roof inspection before the insurance adjuster arrives.

- File your claim promptly – Contact your insurance company within days of the storm.

- Meet with the adjuster – Have your contractor present to ensure all damage is identified.

- Review estimates carefully – Compare the adjuster’s estimate with your contractor’s assessment.

- File supplements if needed – Texas law requires insurers to respond within 15 business days.

- Understand payment structure – Expect two checks: Actual Cash Value (ACV) first, then Recoverable Depreciation.

Critical Texas Law: It is illegal for roofing contractors to waive or absorb your insurance deductible. Any company offering a “free roof” is committing insurance fraud under Texas Insurance Code Section 707.

I’m Matthew Runyon, President of EMC Remodeling & Roofing. With over 15 years of experience, I’ve helped hundreds of Central Texas homeowners steer roof insurance claims in Pflugerville, TX. Our team provides 24/7 emergency roof repair services and ensures you receive a fair settlement and quality repairs for hail, wind, or leak damage. Understanding this process can prevent claim denials, reduce delays, and save you thousands in out-of-pocket costs.

Before You File: Mastering Your Texas Homeowner’s Policy

Before filing a roof insurance claim in Pflugerville, TX, you must understand your homeowner’s insurance policy. This document dictates what is covered, how your payout is calculated, and what responsibilities you have as the policyholder. Proactive knowledge consistently reduces disputes, shortens claim timelines, and lowers out-of-pocket surprises for Texas homeowners. For a broader overview of the entire claims process, review our guide on insurance roof claims.

When reviewing your policy, pay close attention to:

- Covered Perils: What types of damage does your policy cover? Most Texas policies include damage from hail, wind, fire, and falling objects, which are the most common causes of roof damage in Pflugerville.

- Exclusions: What is not covered? Common exclusions are normal wear and tear, poor maintenance, and pre-existing issues. It is vital to differentiate sudden storm damage from problems caused by an aging roof.

- Deductibles: This is your out-of-pocket cost before insurance coverage begins. We will explore this in more detail.

- Coverage Type: Is your roof covered at Replacement Cost Value (RCV) or Actual Cash Value (ACV)? This is the single most significant factor in your claim payout.

Understanding these elements helps you set realistic expectations for your claim and decide when a storm-related repair should be turned into a formal claim.

RCV vs. ACV: What Every Pflugerville Homeowner Must Know

The difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV) directly determines how much money you receive when your roof is damaged.

Replacement Cost Value (RCV)

- Definition: RCV pays to replace your damaged roof with new materials of similar quality at current prices, without subtracting for depreciation. It covers the full cost to restore your roof to its pre-storm condition, subject to policy limits.

- Payout Structure: You typically receive two checks. The first is for the ACV, and the second (recoverable depreciation) is released after repairs are complete and final invoices are submitted.

- Benefit: This coverage ensures you are not left with a large out-of-pocket expense purely because your roof is older.

Actual Cash Value (ACV)

- Definition: ACV pays the replacement cost of your roof minus depreciation. Depreciation is a value reduction based on age, wear, and condition.

- Payout Structure: You receive a single payment based on the depreciated value, which often leaves a sizable gap between the payout and the actual cost of a new roof.

- Impact: An ACV policy on an older roof provides significantly less money, making you responsible for a larger portion of the replacement cost.

Example: A 15-year-old roof needs a $15,000 replacement.

- With RCV: Your policy would pay the full $15,000 (minus your deductible).

- With ACV: After depreciation, your policy might only pay $8,000–$10,000 (minus your deductible), leaving you to cover the remaining $5,000–$7,000.

We recommend RCV coverage in storm-prone regions like Pflugerville because it aligns better with the real-world cost of replacing hail-impacted and wind-damaged systems. Check your policy documents or speak with your agent to confirm your coverage type, as it can change at renewal. The Texas Department of Insurance offers more details in their video on RCV vs ACV.

| Feature | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Coverage Amount | Pays full cost to replace with new materials (minus deductible) | Pays replacement cost minus depreciation (minus deductible) |

| Out-of-Pocket | Lower (only deductible) | Higher (deductible + depreciation) |

| Payout Structure | Two checks (ACV first, then recoverable depreciation) | One check (depreciated value) |

| Example (15-yr old roof, $15k replacement) | ~$15,000 (minus deductible) | ~$8,000 – $10,000 (minus deductible) |

| Depreciation | Not applied in final settlement | Subtracted based on age, condition, and expected lifespan |

Understanding Your Deductible for Roof Claims in Texas

Your deductible is the amount you pay out of pocket before your insurer pays for covered damages. Its application can vary for roof claims in Texas, especially for wind and hail events that frequently impact Pflugerville.

Types of Deductibles in Texas:

- Flat-Rate Deductible: A fixed dollar amount (for example, $1,000 or $2,500).

- Percentage-Based Deductible: A percentage of your home’s insured value (for example, 1% or 2%). For a $300,000 home with a 2% deductible, you would pay $6,000.

- Wind/Hail-Specific Deductibles: Common in Texas, your policy may have a separate, higher percentage-based deductible for wind and hail damage.

How Deductibles Impact Your Claim Payout:

The deductible is subtracted from the total approved claim amount. If your damage is estimated at $12,000 with a $2,500 deductible, your insurer will pay $9,500.

Texas Law and Your Deductible:

Texas Insurance Code Section 707 makes it illegal for a roofing contractor to waive, absorb, or rebate any part of your insurance deductible. You are legally obligated to pay it, and invoices must reflect the true cost of work. For more information, the TDI guide to replacing your roof is an excellent resource and is frequently cited by Texas adjusters and contractors alike.

The 7-Step Process: Navigating Roof Insurance Claims in Pflugerville, TX

Dealing with storm damage is overwhelming, but a structured approach to your roof insurance claim in Pflugerville, TX dramatically improves your odds of a full and fair settlement. Homeowners who follow a clear process typically see faster resolutions and fewer disputes with their carrier. The steps below reflect best practices we use on real claims across Central Texas. If you also need non-claim-related repair help, explore our dedicated page on roof inspection in Pflugerville, TX.

Step 1 & 2: Document Damage and Prevent Further Loss

Your immediate actions after suspecting roof damage are critical for a successful claim and for protecting your home from additional harm.

Step 1: Document the Damage Immediately

As soon as it is safe, document all observable damage. Strong evidence is the foundation of a well-supported claim.

- Date-stamped Photos and Videos: Use your smartphone to take clear photos and videos. Capture wide shots and close-ups of damage to shingles, gutters, vents, siding, and windows. Document any interior water stains or active leaks.

- Detailed Notes: Record the storm’s date and time, the type of weather you experienced, and the location of all damage.

- Why it Matters: This documentation serves as proof, helping to differentiate new storm damage from pre-existing issues and normal aging.

Step 2: Mitigate Further Damage (and keep receipts!)

Your policy requires you to take reasonable steps to prevent further damage after a loss.

- Emergency Roof Repair: If you have active leaks, our team can provide emergency roof repair services, such as temporarily tarping the damaged area.

- Protect Interiors: Move valuables away from leaks, cover furniture with plastic, and use buckets to catch water.

- Keep Receipts: Document all costs for temporary repairs and cleanup with receipts, as these expenses may be reimbursable under your policy.

Step 3 & 4: Schedule a Professional Roof Inspection and File Your Claim

These steps involve getting an expert assessment and formally starting the insurance process.

Step 3: Schedule a Professional Roof Inspection BEFORE the Adjuster Arrives

This critical step, often overlooked, can significantly impact your claim’s outcome.

- Importance of a Pre-Claim Inspection: An insurance adjuster’s role is to evaluate damage within the limits of your policy, and initial scopes are frequently conservative. A professional roofer will conduct a thorough assessment, identifying both obvious and hidden damage an adjuster might miss.

- Contractor’s Detailed Report: Our team provides a comprehensive report with photos, detailing all damage and estimated repair costs. This report serves as your advocate and an independent assessment to compare with the adjuster’s findings.

- Identifying Hidden Damage: Hail can bruise shingles, causing future leaks, while wind can break shingle seals without detaching them. Our experts use a 13-point system for roof inspection in Pflugerville, TX to ensure nothing is missed.

- Why It’s a “Must-Do”: Our assessment prepares you for the adjuster’s visit, giving you leverage and helping to prevent an underpaid claim.

Step 4: Contact Your Insurance Company Promptly to File Your Claim

After documenting the damage and getting our assessment, notify your insurer.

- Prompt Filing: File quickly. Most policies have a one-year deadline, but prompt filing prevents complications and helps your carrier tie the loss to a specific weather event.

- Who to Call: We recommend having your agent help you file the claim to ensure it is coded correctly (for example, hail versus wind, or named storm events).

- Information to Provide: Have your policy number, storm date, and a concise damage description ready. Mention you have a professional inspection report.

- Claim Number: Keep the claim number provided by the insurer for all future communications.

Step 5, 6, & 7: Adjuster Meeting, Estimate Review, and Supplemental Claims

These final steps involve direct interaction with your insurer to secure a fair settlement.

Step 5: Meet with the Insurance Adjuster

Your insurer will send an adjuster to assess the damage.

- Contractor Advocacy: We strongly recommend having your roofing contractor present. Our project supervisor will walk the roof with the adjuster, pointing out all identified damage to ensure nothing is missed. This helps confirm all storm-related damage is considered within the scope.

Step 6: Review the Adjuster’s Estimate Carefully

After the inspection, the insurer provides a repair estimate.

- Compare Estimates: Compare the adjuster’s estimate line by line with our detailed report. Initial insurance estimates are often 20–40% below the actual repair cost when code upgrades and hidden components are included.

- Identify Discrepancies: Common discrepancies include missed damage, incorrect measurements, missing line items (flashing, vents, code upgrades), and outdated pricing.

- Do Not Accept Without Question: Accepting the first estimate without a careful review is a costly mistake, especially for full roof replacements.

Step 7: File a Supplemental Claim if Necessary

If the adjuster’s estimate is insufficient, you can file a supplemental claim.

- How to File a Supplement: We help you prepare and submit a detailed supplement outlining all discrepancies, supported by our report, photos, building-code references, and current pricing.

- Texas Law on Response Time: Texas law requires insurers to respond to supplemental claims within 15 business days. We work to ensure these are processed efficiently.

- Advocacy: Our team advocates for you, ensuring all storm-related damages covered by your policy are included in the final scope, even if it requires multiple rounds of documentation.

After Approval: Payments, Scams, and Choosing the Right Pflugerville Roofer

Once your roof insurance claim in Pflugerville, TX is approved, the focus shifts from negotiation to execution. Understanding how payments work, recognizing common scams, and selecting a qualified local roofer are the three factors that most strongly determine the long-term performance of your new roof. If you need a full-service partner that can handle both claims and non-claim projects, explore our Pflugerville roofer near me page.

The Two-Check System: How Insurance Pays for Your New Roof

With Replacement Cost Value (RCV) coverage, your payout typically comes in two checks. This system is designed to make sure approved work is actually completed before the full amount is paid.

First Check (Actual Cash Value – ACV):

- This initial payment covers the roof’s depreciated value, minus your deductible.

- It is issued upfront to help you start repairs.

- Mortgage Company Endorsement: If you have a mortgage, this check is often payable to both you and your lender, requiring their endorsement before you can deposit it. This additional step can take several weeks.

Second Check (Recoverable Depreciation):

- This payment covers the remaining amount—the difference between ACV and the full RCV.

- Release Condition: It is released after work is done and we submit a final invoice and Certificate of Completion to your insurer.

After receiving the first check, you pay your deductible and the ACV amount to us to begin work. Once the roof is finished, we submit the final documents to release the second check, which you then use for the final payment. This structure keeps the project funded without exposing you to unnecessary financial risk.

Red Flags: Avoid Roofing Scams and Illegal Deductible Waiving

After major storms, Pflugerville often sees a spike in roofing scams. Homeowners must be vigilant to avoid illegal practices and substandard workmanship.

- “Free Roof” Scams and Deductible Waiving: This is the biggest red flag. Any contractor offering to “waive” or “cover” your deductible is breaking the law.

- Texas Insurance Code Section 707: This law makes it a Class B misdemeanor for both the contractor and homeowner to conspire to avoid paying the deductible. Penalties can include up to 180 days in jail and a $2,000 fine.

- How it Works (Illegally): Fraudulent contractors may offer rebates or inflate the invoice to cover the deductible. This is insurance fraud. The Texas Department of Insurance (TDI) provides more information in this TDI video on deductible scams.

- High-Pressure Sales Tactics and Storm Chasers: Beware of unsolicited contractors who pressure you to sign a contract on the spot. “Storm chasers” often come from out of state, perform low-quality work, and disappear, leaving you with no warranty support.

- Lack of Documentation: A reputable contractor always provides a detailed, written contract that lists materials, scope, price, and warranty terms. Avoid verbal agreements under any circumstance.

To protect yourself, always demand a written contract and never work with a contractor who suggests breaking the law. We handle every roof insurance claim in Pflugerville, TX ethically and legally, with transparent pricing that matches the work actually performed.

Why Choose a Local Pflugerville Roofing Contractor

Selecting the right contractor for your roof insurance claim in Pflugerville, TX is as important as the claim itself. A local company like EMC Remodeling offers specific advantages that out-of-town storm chasers cannot match.

- Knowledge of Local Building Codes: A local contractor is familiar with Pflugerville’s specific building codes and inspection requirements, ensuring your new roof is compliant and passes on the first review.

- Experience with Regional Storms: We understand the patterns of Texas hail and wind events and know which roofing assemblies and materials perform best under Central Texas conditions.

- Year-Round Accountability: We live and work in the community and are here to honor workmanship warranties and perform future maintenance.

- Verifying Credentials: Reputable companies demonstrate their professionalism. Check for:

- RCAT Membership: The Roofing Contractors Association of Texas (RCAT) offers a voluntary licensing program and clear standards.

- BBB Rating: Review their rating and complaint history on the Better Business Bureau (BBB).

- Insurance: Always ask for proof of general liability and workers’ compensation to protect yourself from liability.

- Workmanship Warranties: A local contractor stands behind their work. We offer robust workmanship warranties (up to 25 years) in addition to manufacturer warranties, providing long-term peace of mind.

For a reliable roofer near me in Pflugerville, TX, choose a company with deep community roots, a track record of emergency response, and proven experience in handling insurance-driven roof replacements and repairs.

Frequently Asked Questions about Pflugerville TX Roof Insurance Claims

Navigating a roof insurance claim in Pflugerville, TX brings up many questions. The answers below reflect how claims are typically handled in Texas and are based on real cases we manage across Central Texas.

Will filing a storm damage claim raise my insurance rates in Texas?

Answer: Texas law prohibits insurers from raising an individual homeowner’s premiums solely because the homeowner filed a claim for weather-related events like hail or wind. Insurers are allowed to adjust rates for an entire geographic area if that region experiences a high volume of claims, but that is a market-wide revision, not a penalty for your specific claim.

How long do I have to file a roof claim after a storm in Texas?

Answer: Most Texas insurance policies require homeowners to file a claim within one year of the storm event. Some carriers may have shorter or longer contractual deadlines, which are spelled out in your policy. Filing as soon as possible is critical to prevent further damage, preserve evidence, and ensure a smoother claim process.

What if my insurance claim is denied?

Answer: A denied claim is not the final word. You have the right to appeal and to request a second look.

- Request a Written Denial: Ask your insurer for a detailed written explanation for the denial, including the policy language they relied on.

- Get a Second Opinion: We can provide a comprehensive, independent assessment of your roof damage to serve as new evidence. For complex or large losses, some homeowners also consult a licensed public adjuster.

- Submit New Evidence: Provide our detailed report, photos, and any additional documentation to your insurance company.

- Request a Re-inspection: Ask for a different adjuster to conduct a re-inspection. We recommend having your roofing contractor present to advocate for you and point out all storm-related damage.

- Escalate if Needed: If your claim remains denied or underpaid, you can explore formal complaint options through the Texas Department of Insurance or consult legal counsel.

We have extensive experience helping homeowners appeal denied claims and can guide you through each step, from new documentation to re-inspection support.

Get Expert Help With Your Pflugerville Roof Claim Today

Navigating roof insurance claims in Pflugerville, TX requires expertise and precision, particularly when severe weather has already compromised your home’s structural integrity. Professional guidance significantly reduces the risk of claim underpayment or denial while ensuring your roof is restored to pre-storm condition. The difference between handling a claim alone versus with expert support often amounts to thousands of dollars in recovered costs.

EMC Remodeling brings over 15 years of Central Texas storm damage experience to every insurance claim we handle. Our team provides comprehensive support from initial damage assessment through final payment collection, including 24/7 emergency response for active leaks. We document damage thoroughly, advocate directly with adjusters, and ensure all storm-related repairs meet current building codes. Our proven track record includes successfully appealing denied claims and securing proper compensation for hidden damage that initial inspections missed.

Our commitment extends beyond paperwork – we deliver superior craftsmanship using premium materials backed by industry-leading warranties. As a family-operated business serving Temple, Lago Vista, Cedar Park, Leander, Georgetown, Killeen, Belton, Pflugerville, and Salado, we maintain year-round accountability for every roof we install. Direct owner involvement ensures consistent quality control and rapid resolution of any concerns.

For immediate assistance with your roof insurance claim or to schedule a free inspection, contact our Pflugerville roofing specialists today. Call 512-484-0313 now for 24/7 emergency support and expert claim guidance. We respond within hours to prevent further damage and begin documenting your claim immediately.